Outline:

- Introduction

- Understanding Share Prices

- Factors Influencing Share Prices

- Company Performance

- Market Conditions

- Investor Sentiment

- Economic Indicators and Share Prices

- News and Events Impacting Share Prices

- Behavioural Finance and Share Prices

- Volatility and Share Prices

- Technical Analysis and Share Prices

- Long-Term Investing Perspective

- Conclusion

- FAQs

Article:

Introduction

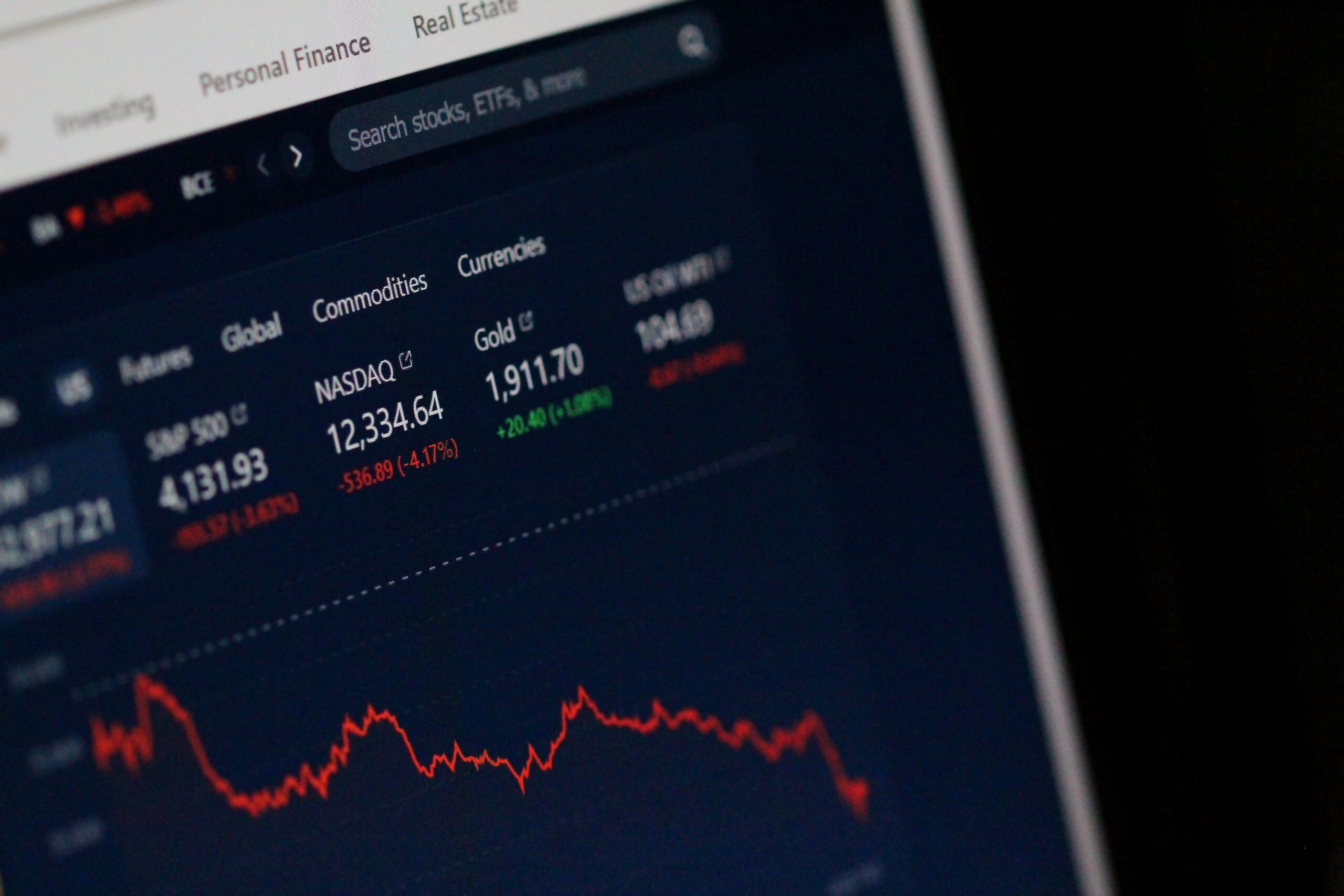

Investing in the stock market can be both exciting and challenging. One of the key aspects of stock market investing is understanding why share prices go up and down. Share prices are constantly fluctuating, driven by a multitude of factors. In this article, we will explore the various reasons behind these price movements and gain a deeper understanding of the dynamics of the stock market.

Understanding Share Prices

Share prices represent the value of a company’s stock at a given point in time. They are determined by the forces of supply and demand in the stock market. When there is high demand for a stock, the price tends to rise, and when there is more supply than demand, the price tends to fall. The interaction between buyers and sellers in the market determines the share price.

Factors Influencing Share Prices

Several factors play a role in influencing share prices. These factors can be broadly categorized into three main categories: company performance, market conditions, and investor sentiment.

Company Performance: The financial performance of a company has a significant impact on its share price. Factors such as revenue growth, profitability, and future prospects all contribute to investor perceptions of the company’s value. Positive earnings reports, new product launches, and effective management can drive share prices upward, while poor financial results or negative news can lead to a decline.

Market Conditions: Broader market conditions also influence share prices. Factors such as interest rates, inflation, and overall economic growth impact investor confidence and risk appetite. Bull markets, characterized by rising share prices, generally coincide with favourable economic conditions, while bear markets, marked by falling share prices, reflect a more pessimistic market sentiment.

Investor Sentiment: The psychology of investors plays a crucial role in share price movements. Investor sentiment can be influenced by factors such as market news, rumours, geopolitical events, and investor behaviour. Positive sentiment can create buying pressure, leading to higher share prices, while negative sentiment can trigger selling pressure, causing prices to decline.

Economic Indicators and Share Prices

Economic indicators, such as gross domestic product (GDP), employment data, and consumer confidence, provide valuable insights into the overall health of the economy. These indicators can have a significant impact on share prices. For example, strong GDP growth and low unemployment rates often lead to increased investor confidence and higher share prices. Conversely, a slowdown in economic activity or rising unemployment can dampen investor sentiment and drive share prices down.

News and Events Impacting Share Prices

News and events, both within and outside the business world, can have a significant impact on share prices. Company-specific news, such as mergers and acquisitions, product recalls, legal disputes, or changes in management, can cause sharp price movements. Additionally, global events like political developments, natural disasters, or changes in regulations can create volatility in the stock market, affecting share prices across various industries.

Behavioural Finance and Share Prices

Behavioural finance explores how human biases and emotions influence investment decisions. It helps explain why share prices often deviate from rational expectations. Behavioural biases, such as herd mentality, confirmation bias, and fear of missing out (FOMO), can lead to excessive buying or selling, causing share prices to be driven by emotions rather than fundamentals. Understanding these biases can provide insights into the volatility and fluctuations observed in the stock market.

Volatility and Share Prices

Volatility refers to the rapid and significant price fluctuations observed in the stock market. While volatility can create opportunities for traders, it can also lead to significant risks. Factors such as economic uncertainty, geopolitical tensions, or sudden shifts in investor sentiment can contribute to increased volatility. Share prices tend to be more volatile during periods of market turbulence, and investors need to be mindful of the potential risks associated with such volatility.

Technical Analysis and Share Prices

Technical analysis involves studying historical price and volume data to make investment decisions. Technical analysts believe that past price patterns can provide insights into future price movements. Various indicators, such as moving averages, support and resistance levels, and chart patterns, are used to identify trends and potential buying or selling opportunities. While technical analysis is not fool proof, it is widely used by traders to make short-term investment decisions, which can impact share prices in the short run.

Long-Term Investing Perspective

While short-term price fluctuations can be influenced by numerous factors, long-term investing focuses on the fundamental value of a company. Share prices in the long run tend to align with the underlying fundamentals of the business, such as revenue growth, earnings stability, and competitive advantage. Long-term investors often look beyond the day-to-day volatility and focus on the potential for sustained growth over time.

Conclusion

In conclusion, share prices go up and down due to a complex interplay of factors. Company performance, market conditions, investor sentiment, economic indicators, news and events, behavioural finance, volatility, and technical analysis all contribute to the fluctuations in share prices. Understanding these dynamics is essential for investors to make informed decisions and navigate the stock market successfully.

FAQs

What is the primary driver of share price movements? Share prices are primarily driven by the forces of supply and demand in the stock market. When there is more demand than supply, prices tend to rise, and vice versa.

How often do share prices change? Share prices can change frequently throughout the trading day. They are influenced by real-time market conditions and the continuous buying and selling of stocks.

Can news events alone cause significant changes in share prices? Yes, significant news events, such as earnings announcements, mergers and acquisitions, or regulatory changes, can have a substantial impact on share prices.

Why do share prices sometimes deviate from a company’s fundamental value? Share prices can deviate from a company’s fundamental value due to various factors, including market sentiment, investor psychology, and short-term trading dynamics influenced by technical analysis and behavioural biases.

What is the importance of long-term investing when share prices fluctuate? Long-term investing focuses on the underlying fundamentals of a company and aims to capture sustained growth over time. By taking a long-term perspective, investors can mitigate the impact of short-term price fluctuations.