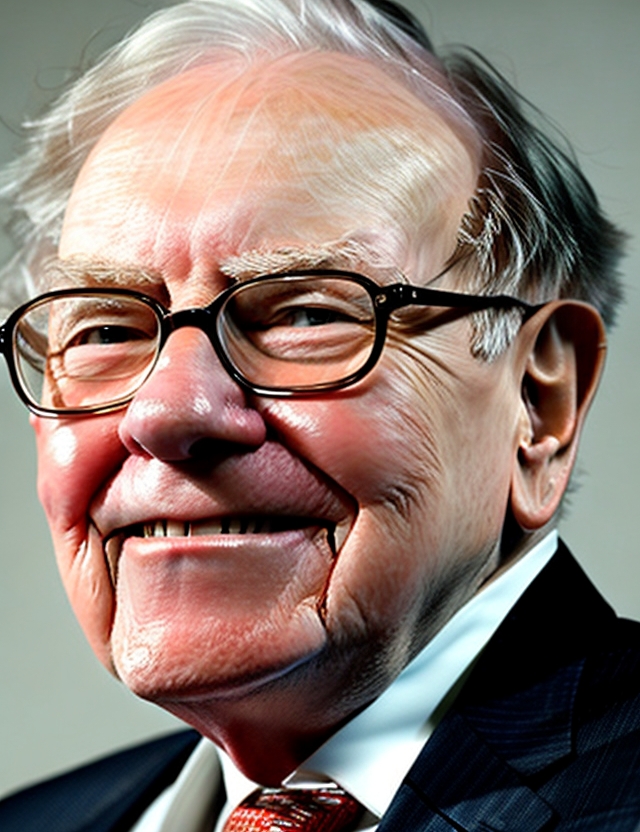

Introduction : Warren Buffett’s Investment Principles

Warren Buffett, widely regarded as one of the most successful investors of all time, has built his fortune through a set of timeless investment principles. With a long-term perspective and a focus on value, Buffett has consistently generated impressive returns for his shareholders. In this article, we will delve into the investment principles that have guided Warren Buffett’s remarkable success.

Table of Contents

- The Power of Patience: Long-Term Investing

- Value Investing: Buying Undervalued Stocks

- Margin of Safety: Protecting Against Downside Risk

- Focus on Quality Companies

- Competitive Advantage: Moats and Sustainable Businesses

- Understanding the Business: Circle of Competence

- Avoiding Market Timing and Speculation

- Diversification: Concentrated Portfolios

- Emotional Discipline: Be Fearful When Others Are Greedy

- Management and Leadership: Trustworthy and Competent

- Financial Statements Analysis: Fundamental Research

- Staying Informed: Continuous Learning

- Leverage and Debt: Conservative Approach

- Avoiding Herd Mentality

- Philanthropy: Giving Back to Society

The Power of Patience: Long-Term Investing

Warren Buffett firmly believes in the power of patience when it comes to investing. He emphasizes the importance of taking a long-term approach and holding investments for extended periods. By avoiding short-term market fluctuations and focusing on the underlying value of businesses, Buffett has been able to capitalize on compounding returns.

Value Investing: Buying Undervalued Stocks

Buffett’s investment philosophy revolves around value investing. He seeks out companies whose stock prices are trading below their intrinsic value. By buying undervalued stocks, Buffett aims to acquire assets at a discount and profit as the market eventually recognizes their true worth.

Margin of Safety: Protecting Against Downside Risk

To mitigate the potential risks associated with investing, Buffett emphasizes the concept of a margin of safety. This principle involves purchasing securities at prices significantly below their intrinsic value. By doing so, Buffett ensures a cushion against unexpected downturns and increases the potential for favorable returns.

Focus on Quality Companies

Buffett looks for companies with strong fundamentals and a proven track record of performance. He emphasizes investing in businesses with a competitive advantage and stable earnings growth. By focusing on quality companies, Buffett aims to build a portfolio of solid, long-term investments.

Competitive Advantage: Moats and Sustainable Businesses

One of the key aspects Warren Buffett considers before investing in a company is its competitive advantage or “economic moat.” A company with a moat has a sustainable competitive advantage over its competitors, making it difficult for new entrants to replicate its success. Buffett seeks businesses with strong moats, as they tend to generate consistent profits and deliver long-term value.

Understanding the Business: Circle of Competence

Buffett stresses the importance of staying within one’s circle of competence when making investment decisions. He advises investors to focus on industries and businesses they understand well. By investing in familiar territory, individuals can make informed judgments and avoid costly mistakes.

Avoiding Market Timing and Speculation

Warren Buffett discourages market timing and speculative investing. Instead, he advocates for a buy-and-hold strategy, allowing investments to grow over time. Buffett believes that attempting to predict short-term market movements is futile and that focusing on long-term value is the key to successful investing.

Diversification: Concentrated Portfolios

Unlike traditional investment advice, Warren Buffett follows a different approach to diversification. Rather than spreading investments across a wide range of assets, Buffett believes in concentrated portfolios. He suggests focusing on a few high-quality investments that align with one’s circle of competence, as this allows for better understanding and monitoring of the investments.

Emotional Discipline: Be Fearful When Others Are Greedy

Buffett understands the impact of emotions on investment decisions. He advises investors to remain disciplined and not succumb to market euphoria or panic. Buffett famously stated, “Be fearful when others are greedy, and be greedy when others are fearful.” By maintaining emotional discipline, investors can take advantage of market opportunities and avoid making irrational decisions.

Management and Leadership: Trustworthy and Competent

When assessing potential investments, Warren Buffett places great importance on the management and leadership of a company. He looks for trustworthy and competent individuals who have a track record of success. Buffett believes that exceptional leadership plays a crucial role in the long-term success of a business.

Financial Statements Analysis: Fundamental Research

Buffett emphasizes the need for thorough fundamental research before making investment decisions. He carefully analyzes a company’s financial statements, assessing its profitability, cash flow, debt levels, and overall financial health. By conducting detailed analysis, Buffett gains insights into the true value and potential risks of an investment.

Staying Informed: Continuous Learning

Warren Buffett is a strong advocate for continuous learning. He stresses the importance of staying informed about the market, industry trends, and economic factors that can impact investments. Buffett spends a significant amount of time reading and acquiring knowledge, allowing him to make well-informed investment choices.

Leverage and Debt: Conservative Approach

Buffett maintains a conservative approach when it comes to leverage and debt. He believes in investing in companies with strong balance sheets and manageable levels of debt. By avoiding excessive leverage, Buffett minimizes the risk of financial instability and ensures the long-term viability of his investments.

Avoiding Herd Mentality

Buffett advises against following the crowd or the “herd mentality” in investing. Instead, he encourages investors to think independently and make decisions based on their own research and analysis. By avoiding herd mentality, individuals can identify unique investment opportunities and potentially achieve superior returns.

Philanthropy: Giving Back to Society

Warren Buffett is a strong advocate for philanthropy. He has pledged a significant portion of his wealth to charitable causes. Buffett believes in the importance of giving back to society and making a positive impact on the world.

Conclusion

Warren Buffett’s investment principles provide valuable insights into successful long-term investing. By following his approach of patience, value investing, and focusing on quality businesses with competitive advantages, investors can enhance their chances of achieving favorable returns. Buffett’s emphasis on emotional discipline, continuous learning, and independent thinking further reinforces the importance of a well-informed and rational approach to investing.

FAQs (Frequently Asked Questions)

1. What is Warren Buffett’s net worth? Warren Buffett’s net worth is estimated to be in the billions of dollars, making him one of the wealthiest individuals globally.

2. How did Warren Buffett become successful? Warren Buffett achieved success through disciplined investing, a long-term perspective, and a keen understanding of businesses and their intrinsic value.

3. Does Warren Buffett diversify his investments? Warren Buffett follows a concentrated portfolio approach, focusing on a few high-quality investments rather than extensive diversification.

4. Can anyone apply Warren Buffett’s investment principles? Warren Buffett’s investment principles can be applied by anyone willing to learn and follow his proven strategies. However, individual research and adaptation to personal circumstances are crucial.

5. What are some recommended books on Warren Buffett’s investment philosophy? Some recommended books on

Read more about Warren Buffett principles : Investment Principles of Warren Buffett

[…] Mastering the Art of Wealth […]