Taxation

Taxation and Tax Planning

Tax Compliance Made Simple: Essential Guide for Individuals & Businesses in 2025

Introduction to Tax Compliance What is Tax Compliance? At its core, tax compliance means following the tax laws and regulations set by the government. It involves correctly calculating your taxable income, filing returns on time, and paying the taxes you owe. It’s not just about filling forms once a year; it’s about maintaining financial discipline … Read more

Income Tax Refund 2025: Step-by-Step Guide to Claim, Check Status & Avoid Delays

Income Tax Refund: A Complete Guide for Taxpayers Check your refund status Introduction Have you ever been pleasantly surprised when money gets credited to your bank account from the Income Tax Department? That’s your income tax refund. It happens when you’ve paid more tax than required. Think of it as the government returning your extra … Read more

5 Key Benefits of the Income Tax Bill 2025 That Could Save You Money

💬 Introduction The Income Tax Bill 2025 has finally landed, and it’s already stirring up discussions across the country. Whether you’re a salaried employee, business owner, or freelancer, this bill affects your financial future. Let’s break down exactly what’s changed, what stays the same, and how you can prepare yourself for the new tax regime. … Read more

ITR 2 and ITR 3 Filing Guide: Essential Updates to File Smarter in AY 2025–26

📌 ITR 2 and ITR 3: Which Income Tax Return Form Should You File for AY 2025–26? Filing your income tax return (ITR) is essential, and choosing the correct form—ITR 2 or ITR 3—can make all the difference. For Assessment Year (AY) 2025–26, understanding the eligibility, rule changes, and filing options for ITR-2 and ITR-3 is crucial. This guide will help … Read more

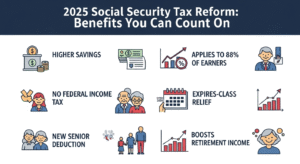

No Tax on Social Security, Federal Tax: What the July 2025 Reform Means for Seniors

Introduction No Tax on Social Security is now a reality for millions of American seniors in 2025. Thanks to a historic tax reform signed into law on July 4th, 88% of retirees will no longer pay federal income tax on their Social Security benefits. This change marks one of the most significant financial reliefs for … Read more

High-Income Tax Planning: The Ultimate Guide to Benefits and Pitfalls in 2025

High-Income Tax Planning: Maximizing Benefits and Minimizing Liabilities in 2025 Introduction Navigating the labyrinth of high-income tax planning can be daunting. However, with the right strategies, you can maximize your benefits while minimizing liabilities. This comprehensive guide will delve into the intricacies of high-income tax planning, offering insights and actionable tips to help you stay … Read more