Kotak mahindra bank q1 results and Overall Earnings Performance

Standalone Profit

Kotak Mahindra Bank’s standalone net profit for Q1 FY26 fell by 7% year‑on‑year, logging in at around ₹3,282 crore, down from ₹3,520 crore in Q1 FY25 The Financial Express+11mint+11Upstox – Online Stock and Share Trading+11Kotak Mahindra Bank+1The Economic Times+1The Economic Times+12The Economic Times+12Moneycontrol+12The Financial Express+6Bajaj Broking+6scanx.trade+6Reuters+3Moneycontrol+3The Economic Times+3Moneycontrol+2scanx.trade+2Moneycontrol+2The Financial Express+1AInvest+1AInvest. Unlike the prior year, this quarter lacked the ₹2,730 crore one‑off gain from selling its stake in Kotak General Insurance, which boosted Q1 FY25 earnings significantly Moneycontrol+2mint+2Upstox – Online Stock and Share Trading+2.

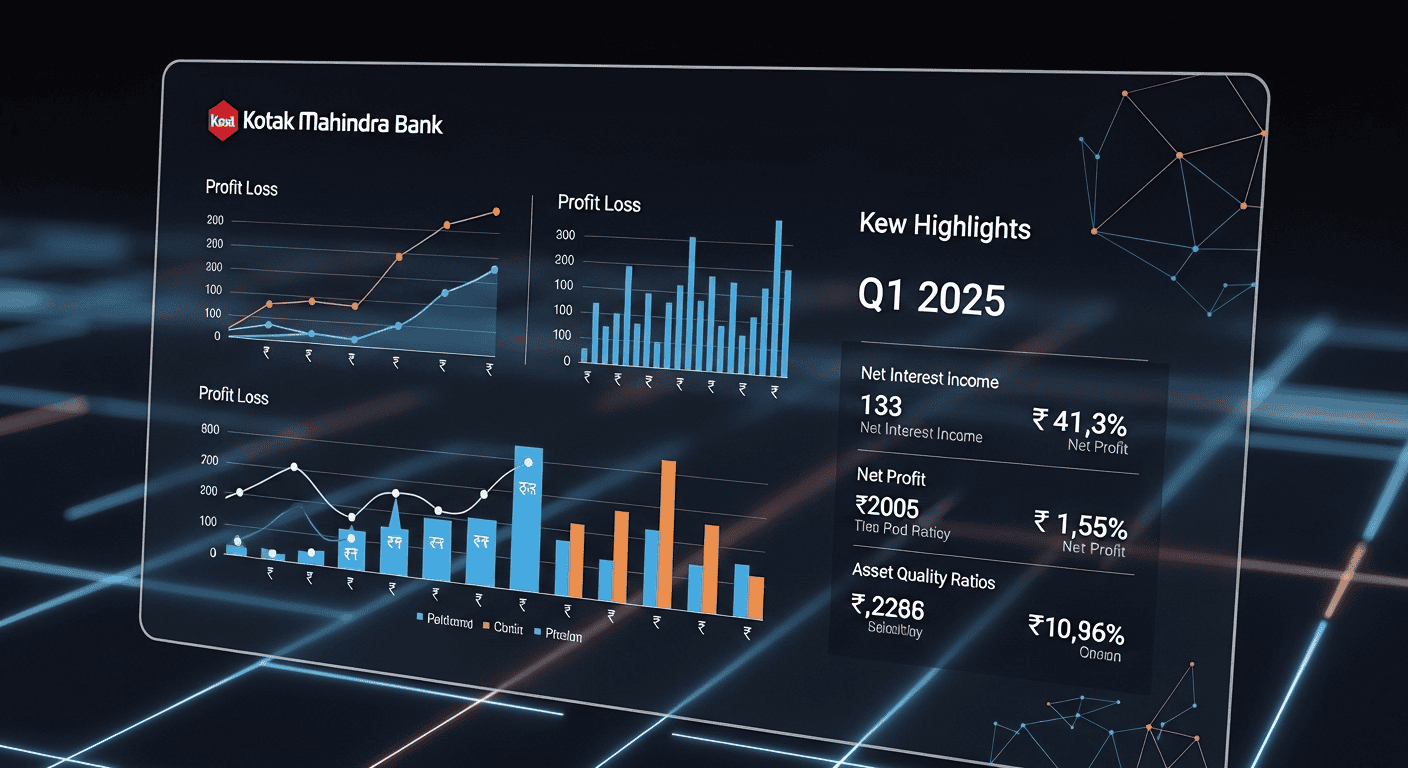

The Kotak Mahindra Bank Q1 results for the financial year 2025 have drawn significant attention from investors and market analysts due to notable shifts in key performance indicators. Despite a headline decline in standalone net profit—largely attributable to the absence of last year’s one-time insurance divestment gain—the bank demonstrated underlying resilience. With net interest income rising by 6% year-on-year and advances growing steadily by over 14%, Kotak’s core banking operations remain robust. However, the drop in net interest margin to 4.65% reflects the broader margin pressure facing the Indian banking sector due to evolving rate dynamics. Analysts were also encouraged by the bank’s asset quality metrics, which remained largely stable, and its conservative provisioning approach that increased the provision coverage ratio to 77%. These aspects make the Kotak Mahindra Bank Q1 results a critical benchmark for evaluating the institution’s risk management, profitability, and long-term strategic positioning.

Consolidated Profit

On a consolidated basis, profit was ₹4,472 crore, reflecting virtually flat growth (≈ +1%) when adjusting for the earlier exceptional gain Bajaj Broking.

Net Interest Income & Margin Trends

NII Growth

Despite headwinds, Kotak’s Net Interest Income (NII) rose around 6% YoY to ₹7,259 crore, up from ₹6,842 crore in the prior year scanx.trade+15mint+15The Economic Times+15. This indicates sustained loan growth and interest-bearing assets driving income.

NIM Compression

However, the Net Interest Margin (NIM) declined significantly from 5.02% a year ago to 4.65% in Q1 FY26, as margin compression set in following RBI’s rate cuts AInvest+1The Economic Times+1Bajaj Broking+5Reuters+5AInvest+5. The lag in deposit rate reductions versus lending rate cuts squeezed spreads.

Loan & Deposit Growth

Advances & Credit Growth

The bank achieved 14% YoY growth in net advances to ₹444,823 crore, bolstered by robust retail lending, which grew 16% QoQ, and SME/corporate lending expanding faster AInvestThe Economic Times+1Bajaj Broking+1.

CASA & Deposit Mix

Total deposits rose around 13–15% YoY to ₹4.9–5.13 lakh crore, with the CASA ratio declining to 40.9% from higher levels the previous year. Term deposits surged, increasing the cost of funds to 5.01% The Economic Times+10The Economic Times+10AInvest+10.

Asset Quality & Provisions

Gross and Net NPAs

Asset quality saw mild deterioration: GNPA rose from 1.39% to 1.48%, while NNPA remained stable around 0.34% Reuters+4The Economic Times+4AInvest+4.

Provision Coverage Ratio

Provisions surged, more than doubling YoY to ₹1,208 crore, boosting the Provision Coverage Ratio (PCR) to a robust 77%, reflecting conservative risk management amid credit stress AInvest+4scanx.trade+4AInvest+4.

Cost Efficiency & Operating Profit

Operating Profit Growth

Kotak’s operating profit rose approximately 6% YoY to ₹5,564 crore, on the back of controlled costs and moderate revenue growth Upstox – Online Stock and Share Trading+3Bajaj Broking+3AInvest+3.

Cost‑to‑Income Ratio

The bank maintained cost discipline with a cost‑to‑income ratio below 50%, aligning with sector norms and enabling leverage despite margin pressures AInvest.

Segment Highlights & Risk Areas

Retail & Microfinance Stress

Stress in microfinance and unsecured retail portfolios, including credit cards and personal loans, remained a concern. Elevated delinquencies contributed heavily to provisioning levels AInvest.

Commercial Vehicle Loans

Retail commercial vehicle (CV financing) carried stress too, with heightened delinquency rates pushing credit costs higher during the quarter mint+15scanx.trade+15The Times of India+15.

Peer Comparison – HDFC & Axis Banks

NIM & Profit Growth Comparisons

While Kotak’s NIM dropped to 4.65%, peers like HDFC Bank (~3.5%) and Axis Bank (~3.8%) also saw compression, but Kotak remains comparatively stable given stronger retail deposit traction AInvest+2The Financial Express+2AInvest+2.

Asset Quality Benchmarks

Kotak’s NNPA at ~0.34% is marginally better than Axis (~0.45%) and HDFC (~0.47%), indicating stronger asset risk control at Kotak The Financial ExpressThe Economic Times.

Capital Strength & Expansion

Capital Adequacy Ratio

Kotak maintains strong capital buffers with a CET1 ratio of approximately 21.8% and overall CAR near 23%, supporting future growth battles AInvest+1The Economic Times+1.

Branch & Digital Reach

With over 2,154 branches and expanding digital services—such as the Kotak 811 platform and contactless offerings—the bank continues broadening its reach and cost-efficiency Kotak Mahindra Bank+3The Financial Express+3NDTV Profit+3.

Management Commentary & Outlook

Margin Trajectory Guidance

Management targeting margin recovery expected in H2 FY26, signaling confidence in stabilizing spreads as deposit rates catch up and CASA strengthens Moneycontrol+1AInvest+1.

Credit Cost Outlook

While Q1 saw peak credit cost, guidance suggests provisions may stabilize or decline in Q2 and beyond, assuming retail delinquencies settle The Economic Times+6scanx.trade+6Reuters+6.

Investment Implications

Risks & Opportunities

Short-term headwinds include margin compression, retail/NPA stress, and higher provisioning. But loan growth, digital investments, and capital strength provide a stable platform.

Long‑term Strategic Positioning

Kotak’s focus on SME/corporate lending, improving digital footprint, and disciplined risk management underpin its long-term resilience and make it a potentially valuable play in a recovering cycle.

#KotakMahindraBankQ1Results

#KotakBankEarnings2025

#Q1ResultsKotakMahindra

#KotakMahindraBankFinancials

#KotakQ1Performance

#BankingResultsIndia2025

#KotakEarningsHighlights

#KotakMahindraQ1FY26

#IndianBankingSector

#KotakProfitReport

FAQ Section on kotak mahindra bank q1 results

Q1: What was Kotak Mahindra Bank’s standalone profit in Q1 FY26?

A: ₹3,282 crore, down ~7% YoY excluding one‑off gains AInvestUpstox – Online Stock and Share Trading+9The Economic Times+9The Economic Times+9.

Q2: What caused the large profit drop compared to last year?

A: Q1 FY25 included a ₹2,730 crore exceptional gain from sale of Kotak General Insurance stake.

Q3: How did NII and NIM perform?

A: NII rose 6% YoY to ₹7,259 crore; NIM contracted from ~5.02% to 4.65% due to rate cuts Moneycontrol+8The Economic Times+8AInvest+8.

Q4: How healthy is loan and deposit growth?

A: Advances up ~14% YoY to ₹444,823 crore; deposits up ~13–15% with CASA ratio down to ~40.9%.

Q5: Is asset quality deteriorating?

A: Slightly—GNPA rose to 1.48%, NNPA steady at 0.34%, provisions rose sharply to ₹1,208 crore.

Q6: What’s the outlook for margins and credit cost?

A: Margins likely to improve in H2; provisions expected to moderate as credit cost peaks in Q1.

Conclusion

Kotak Mahindra Bank’s Q1 FY26 results highlight a challenging but transitional phase. Profitability was hit by one-off adjusted comps and margin compression. Yet underlying strength in loan growth, deposits, asset quality control, and a robust capital base all signal strategic resilience. As credit costs stabilize and margins recover, Kotak remains well-positioned for a measured rebound. Investors should watch upcoming commentary on NIMs, deposit mix, and unsecured book trends.

________________________________________________________________________________________________

External links:

- Home: Stay updated with the latest financial news and trends.

- Market Updates: Explore real-time analysis, expert insights, and breaking news covering various financial markets.

- Investment: Learn about various investment strategies to navigate market volatility.

- Personal Finance: Enhance your financial literacy with tips on budgeting, saving, and more.

- Financial Tools: Utilize powerful financial tools like budget calculators and investment trackers.