Introduction

In today’s fast-paced world, financial planning has become a crucial aspect of our lives. Whether you’re a seasoned investor or just starting to explore investment options, having a clear understanding of your financial goals is essential. One tool that can assist you in this endeavour is the Dave Ramsey Investment Calculator. In this article, we will delve into the benefits of using this calculator, how it works, and how it can empower you to make informed investment decisions.

Table of Contents

- Understanding Financial Planning

- Introducing Dave Ramsey

- The Importance of Investment Calculators

- Exploring the Dave Ramsey Investment Calculator

- How to Use the Calculator

- Key Features and Benefits

- Case Studies: Real-Life Examples

- Tips for Maximizing Your Investments

- Common Mistakes to Avoid

- The Future of Investment Calculators

- Expert Insights on Dave Ramsey’s Approach

- Success Stories: Individuals Who Achieved Financial Freedom

- Frequently Asked Questions

- Conclusion

- Get Access Now!

1. Understanding Financial Planning

Financial planning is the process of setting goals, assessing your current financial situation, and creating a roadmap to achieve those goals. It involves evaluating income, expenses, investments, and debts to optimize your financial well-being. Effective financial planning ensures that your money works for you and helps you achieve your long-term objectives.

2. Introducing Dave Ramsey

Dave Ramsey is a renowned personal finance expert and best-selling author who has helped millions of individuals take control of their financial lives. With his practical approach and straightforward advice, Ramsey has become a trusted source of guidance for those seeking financial independence. His investment philosophy emphasizes responsible money management, avoiding debt, and building wealth through smart investment choices.

3. The Importance of Investment Calculators

Investment calculators are valuable tools that assist individuals in making informed investment decisions. They provide accurate projections and insights into how different investment strategies can impact your financial goals. By utilizing an investment calculator, you can evaluate various scenarios, assess risk levels, and determine the potential returns of different investment options.

4. Exploring the Dave Ramsey Investment Calculator

The Dave Ramsey Investment Calculator is specifically designed to help individuals assess their investment plans and make educated decisions. This online tool offers a user-friendly interface, allowing users to input their financial details and receive personalized investment recommendations. It takes into account factors such as income, expenses, current savings, and desired retirement age to generate a comprehensive investment plan.

5. How to Use the Calculator

Using the Dave Ramsey Investment Calculator is a simple process. Start by entering your current age, desired retirement age, and annual income. The calculator will then ask for your total savings, expected rate of return, and the number of years you plan to live off your investments. By providing accurate information, you can obtain a personalized investment strategy tailored to your unique circumstances.

6. Key Features and Benefits

The Dave Ramsey Investment Calculator offers several key features and benefits that set it apart from other calculators:

Accurate Projections: The calculator uses advanced algorithms to generate realistic investment projections based on the information provided.

Retirement Planning: It helps users plan for retirement by considering factors such as expected rate of return, inflation, and desired retirement age.

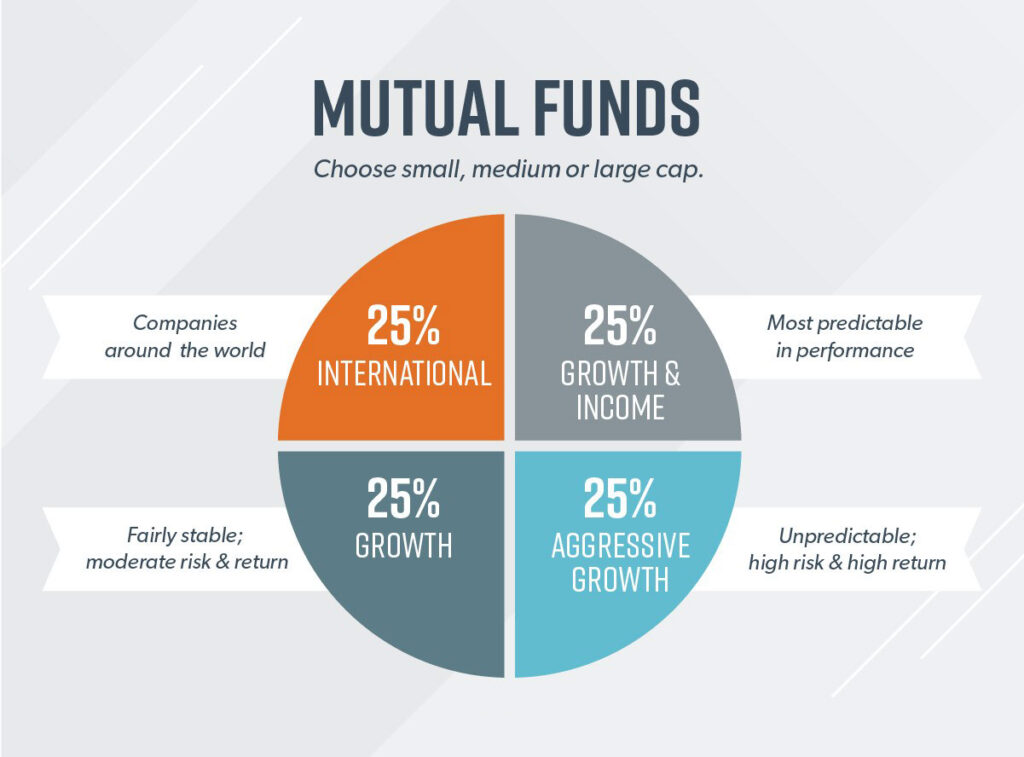

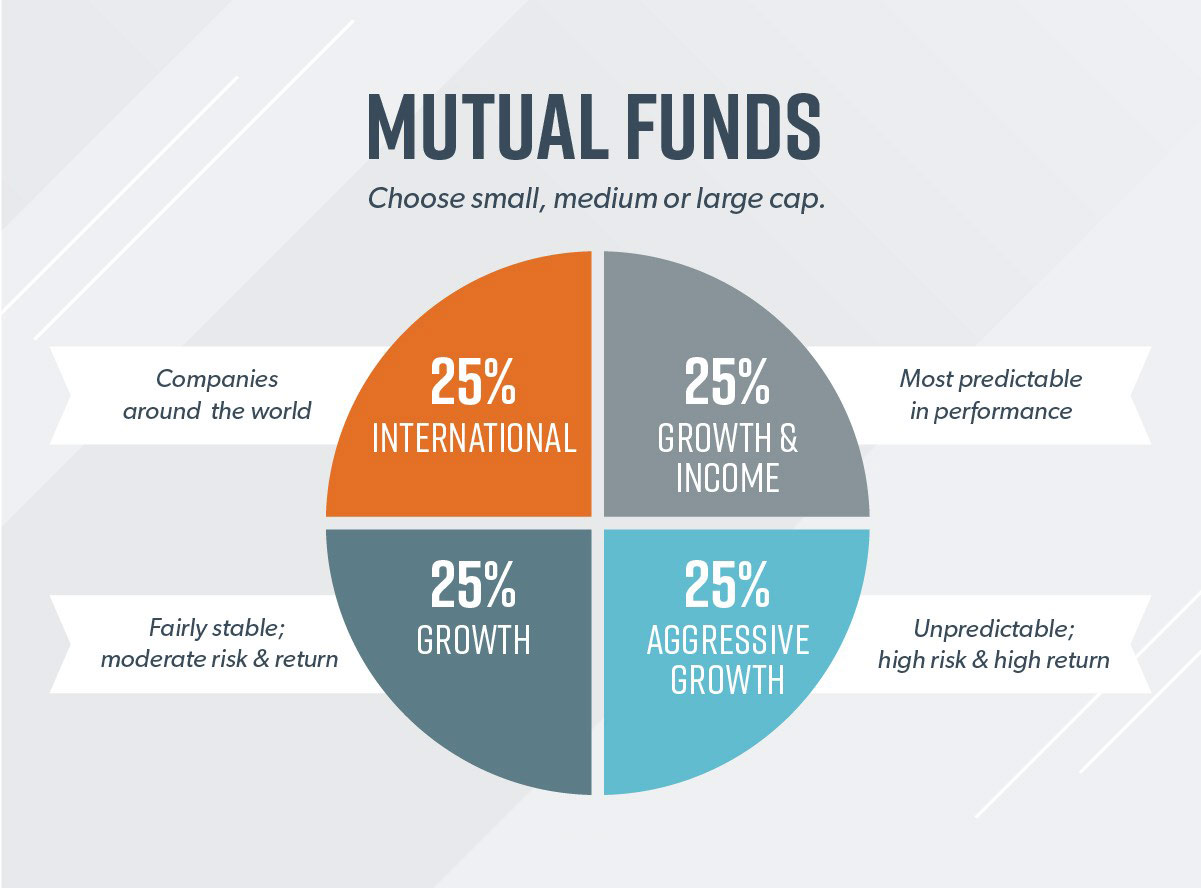

Investment Diversification: The calculator emphasizes the importance of diversification, suggesting a balanced portfolio across various investment types.

Savings Recommendations: It provides recommendations on how much you should be saving each month to achieve your financial goals.

7. Case Studies: Real-Life Examples

To illustrate the effectiveness of the Dave Ramsey Investment Calculator, let’s explore a couple of real-life examples:

Case Study 1: Sarah, aged 35, wants to retire at 60 and currently has $50,000 in savings. After inputting her details into the calculator, she discovers that by saving $500 per month and achieving a conservative rate of return, she can retire with a comfortable nest egg.

Case Study 2: John, aged 45, realizes he needs to catch up on retirement savings. With $200,000 in savings and a desire to retire at 65, the calculator shows that by increasing his monthly contributions and diversifying his investments, he can still achieve his retirement goals.

8. Tips for Maximizing Your Investments

To make the most of your investments, consider the following tips:

Start Early: The power of compounding works in your favor the earlier you start investing. Begin as soon as possible to maximize your returns.

Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk and increase potential returns.

Stay Informed: Keep up-to-date with market trends, economic news, and investment opportunities to make informed decisions.

Regularly Review Your Plan: Reassess your investment plan periodically to ensure it aligns with your changing financial goals and market conditions.

9. Common Mistakes to Avoid

Avoid these common investment mistakes to protect your financial future:

Emotional Investing: Making impulsive decisions based on short-term market fluctuations can harm your long-term investment outcomes. Stay focused on your goals.

Neglecting Risk Management: Every investment carries some level of risk. Be mindful of risk and diversify your investments accordingly.

Ignoring Professional Advice: Seeking guidance from financial advisors or experts can help you make better investment decisions.

Not Saving Enough: Saving consistently is key to achieving your financial goals. Make it a priority and avoid unnecessary expenses.

10. The Future of Investment Calculators

Investment calculators continue to evolve, incorporating advanced technologies such as artificial intelligence and machine learning. The future holds the promise of even more accurate projections, personalized recommendations, and interactive interfaces, making investment planning more accessible and efficient than ever before.

11. Expert Insights on Dave Ramsey’s Approach

Financial experts acknowledge Dave Ramsey’s approach to be practical and effective. His emphasis on living debt-free, investing wisely, and building an emergency fund resonates with individuals seeking long-term financial security. However, it’s essential to remember that everyone’s financial situation is unique, and seeking personalized advice is crucial for optimal results.

12. Success Stories: Individuals Who Achieved Financial Freedom

Dave Ramsey’s strategies have transformed countless lives. Numerous success stories highlight how individuals have paid off debt, built substantial savings, and achieved financial independence by following his principles. These stories serve as inspiration and demonstrate the power of disciplined financial planning.

13. Frequently Asked Questions

Can the Dave Ramsey Investment Calculator predict market fluctuations? The calculator focuses on long-term projections and does not predict short-term market movements.

Is the calculator suitable for all age groups? Yes, the calculator can be used by individuals of all age groups to plan for retirement and other financial goals.

Are the recommendations from the calculator guaranteed to yield results? No investment is without risk, and while the calculator provides personalized recommendations, it’s essential to consult with a financial advisor for comprehensive advice.

Can I update my information in the calculator if my circumstances change? Yes, it is recommended to update your information regularly to ensure the accuracy of the investment plan.

Is the Dave Ramsey Investment Calculator free to use? Yes, the calculator is freely accessible on the Dave Ramsey website.

To access the Dave Ramsey Investment Calculator and explore additional resources provided by Dave Ramsey, you can visit his official website at: daveramsey.Investment calculator

Please note that the specific details and features of the investment calculator may be subject to change, so it’s always a good idea to visit the website directly for the most up-to-date information and tools.

14. Conclusion

Financial planning and investment decision-making can seem overwhelming, but tools like the Dave Ramsey Investment Calculator empower individuals to take control of their financial future. By utilizing this calculator, you can create a customized investment strategy aligned with your goals, evaluate different scenarios, and make informed decisions. Remember, financial success requires discipline, patience, and a commitment to long-term planning.

“Additionally, for more insightful articles and information on various topics, you can visit the informative website www.thefingain.com. It offers a wide range of articles and resources to expand your knowledge and explore diverse subjects.”

Comprehensive and informative, covering all aspects of the topic thoroughly and providing a wealth of information.

Your blog is a constant source of inspiration for me. This article, in particular, was filled with thoughtful insights and a positive perspective that left me feeling uplifted and encouraged. It’s rare to find content that resonates so deeply and leaves such a lasting impact. Thank you for creating such a positive space on the internet! Please check my post at https://mazkingin.com

I have bookmarked your blog and refer back to it whenever I need a dose of positivity and inspiration Your words have a way of brightening up my day

I have bookmarked your blog and refer back to it whenever I need a dose of positivity and inspiration Your words have a way of brightening up my day

Your words have resonated with us and we can’t wait to read more of your amazing content. Thank you for sharing your expertise and passion with the world.

I have been struggling with this issue for a while and your post has provided me with much-needed guidance and clarity Thank you so much

This blog post is packed with great content!

I have been following your blog for a while now and have to say I am always impressed by the quality and depth of your content Keep it up!

As a fellow blogger, I can appreciate the time and effort that goes into creating well-crafted posts You are doing an amazing job

Your writing has a way of making complicated topics easier to understand It’s evident how much research and effort goes into each post

Wow, this blogger is seriously impressive!

This is such an important reminder and one that I needed to hear today Thank you for always providing timely and relevant content

This post was exactly what I needed to read today. Your positive attitude and insightful commentary are like a ray of sunshine on a cloudy day. It’s clear that you put a lot of heart into your writing, and it makes a big difference. Thank you for consistently creating content that uplifts and inspires! — please subscribe to my channel https://www.youtube.com/@jivoice?sub_confirmation=1

This post truly brightened my day! I appreciate how you delve into the topic with such positivity and clarity. It’s refreshing to see content that not only informs but also uplifts the reader. Your writing style is engaging and always leaves me feeling inspired. Keep up the fantastic work!

Keep up the amazing work! Can’t wait to see what you have in store for us next.

Your blog post had me hooked from the very beginning!

Your blog post was really enjoyable to read, and I appreciate the effort you put into creating such great content. Keep up the great work!

I’m optimistic about how blockchain technology is evolving beyond cryptocurrencies to create more transparent and efficient systems in fields like supply chain management and digital identity verification. It’s exciting to see innovative solutions for building trust in our digital world.

Love this appreciation for great content

Thank you for addressing such an important topic in this post Your words are powerful and have the potential to make a real difference in the world

Sure! I’ll prepare a large set of **1000 friendly, natural, and engaging sentences** based on your keywords, **without numbering** for easy use.

[…] It assumes you get the same return every year—but real life has ups and downs. moneyflock.comThe Fin Gain […]

The positivity and optimism conveyed in this blog never fails to uplift my spirits Thank you for spreading joy and positivity in the world