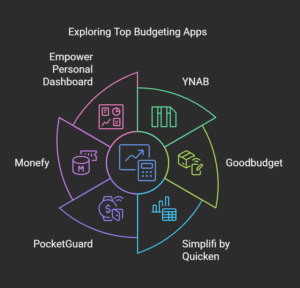

6 Top Budgeting Apps: Your Ultimate Guide to Financial Mastery

Top Budgeting Apps: Your Guide to Financial Mastery Managing finances can be challenging, but budgeting apps have made it easier to track expenses, set goals, and maintain financial health. Here, we explore six of the top budgeting apps that cater to various needs, from comprehensive financial management to simple expense tracking. 1. YNAB (You Need A … Read more