Chandrayaan-3 Latest News

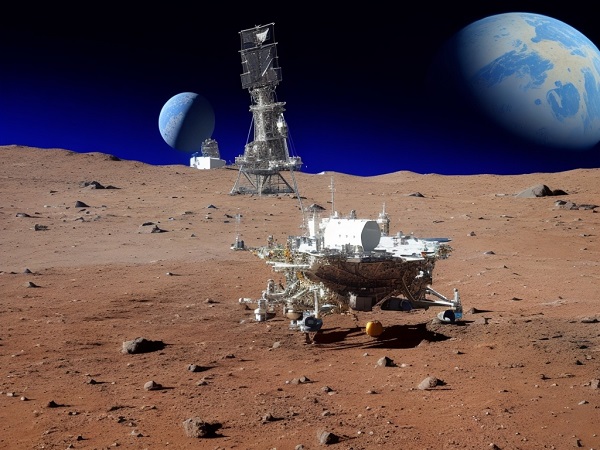

- The historic lunar landing of Chandrayaan-3 is scheduled for August 23, 2023. The spacecraft is currently orbiting the moon after being launched by the Indian Space Research Organization (ISRO) on July 14, 2023. It is currently getting ready for the last drop to the lunar surface after successfully completing all of its planned orbit-raising procedures.

- Near the lunar south pole, that’s where Chandrayaan-3 will come down. Scientists will have a unique opportunity to learn more about the moon’s geology and history because this area has never been visited by another mission.

- The Chandrayaan-3 mission represents a crucial advancement for India’s space program. It is the nation’s third lunar mission and its first attempt at a gentle landing on the south pole of the moon. India would accomplish a great deal with the success of this mission, enhancing its standing as a world leader in space exploration.

Chandrayaan-3 launch date

On July 14, 2023, at 2:35 IST, Chandrayaan-3 was launched from the Satish Dhawan Space Center in Sriharikota, India.

On July 16, 2023, the GSLV Mk III rocket that carried the spacecraft into orbit around the moon was successfully fired. It will now touch down gently on the south pole of the moon on August 23, 2023.

For India’s space program, Chandrayaan-3’s launch was a significant turning point. The third lunar mission for the nation, it was also the first to attempt a gentle landing on the south pole of the moon. India would accomplish a great deal with the success of this mission, enhancing its standing as a world leader in space exploration.

Chandrayaan-3 mission

The Indian Space Research Organization (ISRO) is responsible for the Chandrayaan-3 moon exploration program. It is India’s third lunar mission and the first to try a gentle landing on the south pole of the moon. The mission was started on July 14, 2023, and a soft landing is planned for August 23, 2023..

Three key goals of the Chandrayaan-3 mission are as follows:

- To show off the moon’s surface soft landing potential from beginning to conclusion.

- To carry out in-situ research on the lunar surface.

- To gather information and samples from the lunar surface for upcoming research.

Three components make up the Chandrayaan-3 spacecraft: a lander, a rover, and a propulsion unit. The soft lunar surface landing will be carried out by the lander. From the lander, the rover will be released to undertake research on the lunar surface. The lander and rover will be placed in orbit around the moon by the propulsion module.

For India’s space program, the Chandrayaan-3 mission represents a significant advancement. It is the nation’s first attempt at a soft landing on the south pole of the moon, an area that has not yet been visited by any other spacecraft. India would accomplish a great deal with the success of this mission, enhancing its standing as a world leader in space exploration.

Chandrayaan-3 purpose

The Indian Space Research Organization (ISRO) is responsible for the Chandrayaan-3 moon exploration program. It is India’s third lunar mission and the first to try a gentle landing on the south pole of the moon. The mission was started on July 14, 2023, and a soft landing is planned for August 23, 2023.

Chandrayaan-3’s mission is to:

- Show the capacity to softly land on the moon from beginning to conclusion. Future lunar missions must have this capability in order for researchers to thoroughly examine the lunar surface.

- Performing in-situ research on the lunar surface. Numerous scientific tools are aboard the Chandrayaan-3 spacecraft to investigate the lunar surface’s makeup, the presence of water ice, and the pattern of lunar impacts.

- Collect data and samples from the lunar surface for future analysis. Gather information and samples from the lunar surface for examination in the future.

A huge accomplishment for India and a boost to its standing as a leading spacefaring country would be the accomplishment of the Chandrayaan-3 mission. As well as giving us useful scientific information, it would enable us learn more about the moon’s past.

Chandrayaan-3 budget

Chandrayaan-3 is expected to cost around 615 crore (US$80 million). The price of the spacecraft, the launch vehicle, and the ground-based support equipment are all included in this.

Chandrayaan-3’s budget is considerably smaller than the budgets of earlier lunar missions, such as the Chang’e or Apollo programs. This is due to India’s ability to create several affordable technologies, such as the GSLV Mk III launch vehicle.

Chandrayaan-3’s success would be a significant accomplishment for India because it would show that nation’s capacity to carry out complicated and difficult space missions at a reasonably reasonable cost. Additionally, it would support India’s image as a world space power.

Chandrayaan-3 launch place

Chandrayaan-3 was launched from the Satish Dhawan Space Centre (SDSC) in Sriharikota, Andhra Pradesh, India. At 2:35 PM IST on July 14, 2023, the mission was launched. The Indian Space Research Organisation (ISRO) runs the SDSC, a significant spaceport. About 100 kilometers (62 miles) north of Chennai, it is situated on the Bay of Bengal coast.

Chandrayaan-1, Chandrayaan-2, and Mangalyaan were among the satellites and spacecraft launched using the SDSC. The Vikram Sarabhai Space Centre, the ISRO’s main office, is also located there.

For India’s space program, Chandrayaan-3’s launch was a significant turning point. The third lunar mission for the nation, it was also the first to attempt a gentle landing on the south pole of the moon. India would accomplish a great deal with the success of this mission, enhancing its standing as a world leader in space exploration.

Chandrayaan-3 moon mission

The Indian Space Research Organization (ISRO) is responsible for the Chandrayaan-3 moon exploration program. It is India’s third lunar mission and the first to try a gentle landing on the south pole of the moon. The mission was started on July 14, 2023, and a soft landing is planned for August 23, 2023.

Moon mission Chandrayaan 3

Three key goals of the Chandrayaan-3 mission are as follows:

- Show the capacity to softly land on the moon from beginning to conclusion. Future lunar missions must have this capability in order for researchers to thoroughly examine the lunar surface.

a gentle descent to the lunar surface

- Performing in-situ research on the lunar surface. Numerous scientific tools are aboard the Chandrayaan-3 spacecraft to investigate the lunar surface’s makeup, the presence of water ice, and the pattern of lunar impacts.

Experiments in science on the moon’s surface

- Gather information and samples from the lunar surface for examination in the future. Samples of the lunar surface will be able to be taken by the Chandrayaan-3 rover and sent back to Earth for additional examination.

Data and sample collection from the lunar surface

The Chandrayaan-3 mission’s success would be a significant accomplishment for India and would enhance its standing as a leading spacefaring country. Additionally, it would offer important scientific information that could aid with our understanding of the moon’s past.

Three components make up the Chandrayaan-3 spacecraft: a lander, a rover, and a propulsion unit. The soft lunar surface landing will be carried out by the lander. From the lander, the rover will be released to undertake research on the lunar surface. The lander and rover will be placed in orbit around the moon by the propulsion module.

For India’s space program, the Chandrayaan-3 mission represents a significant advancement. It is the nation’s first attempt at a soft landing on the south pole of the moon, an area that has not yet been visited by any other spacecraft. For India, completing this mission successfully would be a significant accomplishment that would enhance its standing as a premier spacefaring country..

Chandrayaan-3 launch vehicle

Chandrayaan-3 was launched using a GSLV Mk III (Geosynchronous Satellite Launch Vehicle Mark III) launch vehicle. A heavy-lift launch vehicle with three stages, the GSLV Mk III can carry up to 4,000 kilograms (8,800 lb) of payload into geosynchronous transfer orbit.

GSLV Mk III launch vehicle

The Indian Space Research Organization (ISRO) created the GSLV Mk III to satisfy India’s rising demand for launch services. The GSLV Mk III made its first flight in December 2014, and its second flight took place in June 2017.

The Chandrayaan-3 launch vehicle had four strap-on motors since it was configured as a GSLV Mk III-M4. This set-up was chosen to give Chandrayaan-3 the extra thrust it need to reach the moon.

On July 14, 2023, the Chandrayaan-3 launch vehicle was sent into orbit from the Satish Dhawan Space Centre in Sriharikota, India. Chandrayaan-3 has successfully launched and is currently traveling to the moon.

The Chandrayaan-3 launch vehicle’s success is a significant accomplishment for India’s space program. It prepares the way for upcoming lunar missions and shows that India is able to launch large payloads into orbit.

Chandrayaan-3 project director

P Veeramuthuvel is in charge of the Chandrayaan-3 project. He works with the Indian Space Research Organisation (ISRO) as a scientist and has been a part of the Chandrayaan project since the beginning.

In 1972, Veeramuthuvel was born in the Indian state of Tamil Nadu’s Villupuram. He earned a mechanical engineering degree from the Indian Institute of Technology in Madras. Then, in 1995, he joined ISRO and began working on numerous projects, such as the creation of the GSLV Mk III launch vehicle.

2019 saw the appointment of Veeramuthuvel as Chandrayaan-3’s project director. The group of scientists and engineers building and launching the Chandrayaan-3 spacecraft is under his direction.

Veeramuthuvel is a highly qualified engineer with years of experience and a successful track record. He is sure that Chandrayaan-3 will succeed and that it will significantly advance our knowledge of the moon.

When will chandrayaan 3 land

On August 23, 2023, Chandrayaan-3 is slated to touch down on the moon. The area of the moon’s South Pole where the spacecraft will land has not yet been studied by any previous probe.

For India’s space program, the Chandrayaan-3 landing represents a significant accomplishment. It is the nation’s first mission to try a soft landing on the south pole of the moon, and it will yield useful scientific information that could aid in our understanding of the moon and its past.

Given the extreme conditions of the South Pole region of the moon, Chandrayaan-3’s landing will be a difficult achievement. There are craters and boulders all over the surface, and the temperature can plunge to -290 degrees Fahrenheit. The Chandrayaan-3 spacecraft can make a safe landing, according to ISRO, nonetheless.

A successful Chandrayaan-3 landing would be a significant accomplishment for India and would enhance its standing as a premier spacefaring country. Additionally, it would offer important scientific information that could aid with our understanding of the moon’s past.

Speed of chandrayaan 3

The speed of Chandrayaan-3 is not constant; it will change as the spacecraft gets closer or farther from the moon. Chandrayaan-3 is thought to have traveled to the moon at an average speed of about 38,000 kilometers per hour (23,600 miles per hour).

The mass of the spacecraft, the force of its engines, and the gravitational attraction of the Earth and moon are just a few of the variables that affect Chandrayaan-3’s speed. Due to the gravity of the moon, the spacecraft’s speed will likewise rise as it approaches the moon.

In order to make a smooth landing on the moon, Chandrayaan-3 must travel at a speed of at least 1,625 meters per second (5,334 feet per second). The spacecraft’s engines will be able to provide enough push at this speed to slow it down and keep it from colliding with the moon.

A key element in the mission’s success is Chandrayaan-3’s speed. The spaceship won’t have enough time to get to the moon if it moves too slowly. The spacecraft won’t be able to slow down sufficiently to achieve a smooth landing if it is moving too quickly.

Chandrayaan-3’s speed has been precisely determined by ISRO engineers to guarantee the mission’s success. They have also included the likelihood of unforeseen occurrences, like a meteor impact or an engine problem for the spaceship.

Chandrayaan-3’s speed is proof to the ability and knowledge of ISRO engineers. They have created a spacecraft that can land safely on the moon while traveling there quickly.

Why chandrayaan 2 failed

A portion of the Chandrayaan-2 mission failed. Vikram, the lander, successfully ascended into lunar orbit but lost touch with ground control as it descended to the surface. Although the exact reason for the disaster is still unknown, experts believe that a number of things contributed to it, including a software error and an issue with the lander’s descent engine.

India’s second lunar mission, Chandrayaan-2, was also the first attempt to soft-land a spacecraft on the south pole of the moon. The mission was set to land softly on the moon on September 7, 2019, according to its original launch date of July 22, 2019.

Vikram, the lander, was equipped with a variety of scientific tools, such as a camera, a spectrometer, and a seismometer. These devices were created to investigate the lunar surface’s makeup, the presence of water ice, and the pattern of lunar impacts.

Although the loss of Vikram was a significant setback for the Chandrayaan-2 project, the mission was nonetheless ultimately successful. The Chandrayaan-2 orbiter is still in orbit around the moon and is continually gathering data for science.

The reason for Vikram’s failure is still under investigation by the Indian Space Research Organization (ISRO). However, they have expressed confidence that they will be able to draw lessons from the situation and enhance their upcoming lunar missions.

Here are a few potential causes for Chandrayaan-2’s failure:

- Software glitch: The lander may have lost control during the descent as a result of a software error in the navigation system.

- Problem with the descent engine: It’s also possible that the lander’s descent engine had an issue and wasn’t able to fire correctly.

- Error in the navigation data: Another possibility is that the navigation data that was utilized to direct the lander to the surface contained a mistake.

- Unexpected terrain: It’s also possible that the lander’s crash was brought on by unexpected terrain it came upon while descending.

ISRO is still looking into the mishap, even though the precise reason why it occurred is yet unknown. They are sure they will be able to use the experience to better their upcoming lunar missions.

When chandrayaan 2 was launched

On July 22, 2019, at 2:43 IST, Chandrayaan 2 was launched from the Satish Dhawan Space Center in Sriharikota, India.

The National Aeronautics and Space Administration (NASA) and the Indian Space Research Organisation (ISRO) worked together to complete the mission.

India’s second lunar mission, Chandrayaan 2, was also the first attempt to soft-land a spacecraft on the south pole of the moon. On September 7, 2019, the mission was supposed to do a soft landing on the moon, but it lost touch with ground control during the final descent.

Although the loss of Vikram was a significant setback for the Chandrayaan 2 project, the mission was nevertheless ultimately successful. The Chandrayaan 2 orbiter is still in orbit around the moon and is continually gathering data for science.

The reason for Vikram’s failure is still under investigation by the Indian Space Research Organization (ISRO). However, they have expressed confidence that they will be able to draw lessons from the situation and enhance their upcoming lunar missions.

The following are some important details regarding Chandrayaan 2’s launch date:

- Launch date: July 22, 2019

- Launch time: 2:43 pm IST

- Launch site: Satish Dhawan Space Centre, Sriharikota, India

- Launch vehicle: GSLV Mk III-M1

- Mission duration: 12 months

- Mission objectives:

- Soft-land a spacecraft on the moon’s south pole

- Study the composition of the lunar surface

- Search for water ice

- Investigate the history of lunar impacts

FAQ

What is benefit of Chandrayaan-3?

The Indian Space Research Organization (ISRO) is responsible for the Chandrayaan-3 moon exploration program. It is India’s third lunar mission and the first to try a gentle landing on the south pole of the moon. On August 23, 2023, a soft landing on the moon is planned for the mission, which was launched on July 14th, 2023.

Numerous advantages of the Chandrayaan-3 mission include:

- Showcasing the full potential of soft landing on the surface of the moon. Future lunar missions must have this capability in order for researchers to thoroughly examine the lunar surface.

- Scientific research being done in situ on the lunar surface. Numerous scientific tools are aboard the Chandrayaan-3 spacecraft to investigate the lunar surface’s makeup, the presence of water ice, and the pattern of lunar impacts.

- Gathering information and samples from the lunar surface for study in the future. Samples of the lunar surface will be able to be taken by the Chandrayaan-3 rover and sent back to Earth for additional examination.The Chandrayaan-3 mission’s success would be a significant accomplishment for India and would enhance its standing as a leading spacefaring country. Additionally, it would offer important scientific information that could aid with our understanding of the moon’s past.Here are a few other advantages of Chandrayaan-3:

- Our knowledge of the geology and evolution of the moon will be enhanced by the mission.

- It will also enable us to comprehend the likelihood of water ice on the moon.

- The mission might possibly result in the discovery of new minerals and metals on the moon.

- The mission will also serve as inspiration for upcoming generations of engineers and scientists.

All things considered, the Chandrayaan-3 project has the potential to significantly advance our knowledge of the moon and its past. It is a very ambitious objective, and completing it would be a significant accomplishment for both India and the entire world.

What is the speed of Chandrayaan-3?

Sure, I can help you with that.

The speed of Chandrayaan-3 is not a fixed value, as it will vary depending on the distance between the spacecraft and the moon. However, the average speed of Chandrayaan-3 during its journey to the moon is estimated to be around 38,000 kilometers per hour (23,600 miles per hour).

The speed of Chandrayaan-3 is determined by a number of factors, including the mass of the spacecraft, the thrust of its engines, and the gravitational pull of the Earth and the moon. The spacecraft’s speed will also increase as it gets closer to the moon, due to the moon’s gravity.

Chandrayaan-3 will need to reach a speed of at least 1,625 meters per second (5,334 feet per second) in order to achieve a soft landing on the moon. This is the speed at which the spacecraft’s engines will be able to generate enough thrust to slow down the spacecraft and prevent it from crashing into the moon.

The speed of Chandrayaan-3 is a critical factor in the success of the mission. If the spacecraft is too slow, it will not be able to reach the moon in time. If the spacecraft is too fast, it will not be able to slow down enough to make a soft landing.

The engineers at ISRO have carefully calculated the speed of Chandrayaan-3 to ensure that the mission is successful. They have also taken into account the possibility of unexpected events, such as a meteor strike or a malfunction of the spacecraft’s engines.

The speed of Chandrayaan-3 is a testament to the skill and expertise of the engineers at ISRO. They have designed a spacecraft that is capable of traveling to the moon at a high speed and making a safe landing.

Why Chandrayaan is sent to Moon?

There are several reasons Chandrayaan is launched to the Moon, including:

- To show off the moon’s surface soft landing potential from beginning to conclusion. Future lunar missions must have this capability in order for researchers to thoroughly examine the lunar surface.

- To carry out in-situ research on the lunar surface. Numerous scientific tools are aboard the Chandrayaan spacecraft to investigate the lunar surface’s makeup, the presence of water ice, and the pattern of lunar impacts..

- To gather information and samples from the lunar surface for upcoming research. Samples of the lunar surface will be able to be taken by the Chandrayaan rover and sent back to Earth for additional examination.

- To enhance our knowledge of the geology and history of the moon. The Chandrayaan project will aid researchers in their understanding of the moon’s formation and evolution.

- To comprehend the possibility of lunar water ice better. The Chandrayaan project could assist researchers in figuring out whether there is water ice on the moon that could be exploited in upcoming expeditions. Water ice is a valuable resource.

- To find fresh materials, including metals and minerals, on the moon. Scientists may be able to find new lunar resources with the aid of the Chandrayaan expedition for use in upcoming missions.

- To motivate upcoming generations of engineers and scientists. Future generations of scientists and engineers will be motivated to pursue professions in space exploration by the bold and ambitious Chandrayaan program.Overall, the Chandrayaan mission is an important endeavour that could significantly advance our knowledge of the moon and its resources. It is a very ambitious objective, and completing it would be a significant accomplishment for both India and the entire world.

Which country sent Chandrayaan?

India sent Chandrayaan.

The Indian Space Research Organization (ISRO) is conducting a series of lunar exploration missions under the Chandrayaan program. Chandrayaan-1, the series’ initial mission, was launched in 2008. Chandrayaan-2, the second mission, was launched in 2019. Chandrayaan-3, the third mission, is slated to launch in 2023.

The Chandrayaan missions aim to investigate the moon’s composition, history, and surface. The Chandrayaan missions’ spacecraft are equipped with a variety of scientific tools that will be used to gather information and lunar surface samples. Data and samples will be brought back to Earth for additional examination.

The Chandrayaan missions’ success would be a significant accomplishment for India and would enhance its standing as a premier spacefaring country. The missions would also offer important scientific information that could aid in our understanding of the moon and its past.

Additional information on Chandrayaan is provided below:

- Chandrayaan translates from Sanskrit as “moon vehicle” in English.

- The Chandrayaan missions are a component of India’s grand strategy to dominate space exploration.

- The European Space Agency (ESA) and the Russian Space Agency (Roscosmos) are two of the foreign agencies that have worked along with ISRO on the Chandrayaan missions.

Who founded Chandrayaan?

The national space agency of India is called ISRO. Vikram Sarabhai, who is regarded as the father of the Indian space program, founded it in 1969. Space exploration, satellite launches, and space research in India are all handled by ISRO.

The ISRO’s Chandrayaan program consists of a number of moon exploration projects. Chandrayaan-1, the series’ initial mission, was launched in 2008. Chandrayaan-2, the second mission, was launched in 2019. Chandrayaan-3, the third mission, is slated to launch in 2023.

The Chandrayaan missions aim to investigate the moon’s composition, history, and surface. The Chandrayaan missions’ spacecraft are equipped with a variety of scientific tools that will be used to gather information and lunar surface samples. Data and samples will be brought back to Earth for additional examination.

The Chandrayaan missions’ success would be a significant accomplishment for India and would enhance its standing as a premier spacefaring country. The missions would also offer important scientific information that could aid in our understanding of the moon and its past.

Team who work on Chandrayaan-3?

A varied mix of scientists, engineers, and technicians from all throughout India make up the Chandrayaan-3 crew. They are all devoted to the success of Chandrayaan-3 and are all passionate about space exploration.

S. Somanath, the chairman of ISRO, is in charge of the group. Somanath has worked for ISRO for more than 30 years and is a highly skilled aeronautical engineer. He is well-known for his dedication to excellence and leadership abilities.

The team’s other members are as follows:

- Ritu Karidhal Srivastava, the Chandrayaan-3 project manager. Karidhal is a highly competent engineer who has contributed significantly to the creation of a number of fruitful space missions.

- P. Veeramuthuvel, the lander module’s project manager. Engineer Veeramuthuvel has worked in the space sector for more than 20 years.

- Biju C Thomas, the rover module’s project manager. Thomas is a gifted engineer who is extremely knowledgeable in rover technology.

A sizable number of scientists and engineers from ISRO’s numerous locations spread out over India also assist the team. All facets of the Chandrayaan-3 mission are receiving technical guidance and support from these professionals.

The team is optimistic about Chandrayaan-3’s prospects for success. They are exerting a lot of effort to make sure the mission is properly organized and carried out. In order for everyone to profit from India’s space research endeavours, they are also dedicated to sharing the mission’s findings with the rest of the world.

Read more